Kyriba provides the market’s most advanced forex risk management options with considerable business enterprise intelligence abilities for easy identification and knowledge of foreign Trade (Forex) risk.

Kyriba’s income move publicity forecasting Option enables treasury and finance industry experts to build, analyze and control forex publicity from forecasted transactions and hard cash flows.

A draft of your originating agreement has to be reviewed and approved by Lawful Expert services ahead of time of Procurement Products and services getting into right into a spinoff trade with the counterparty.

The Only Guide to What Is Hedging In Financial Risk Management

“I figured out promptly not to produce a move Until I am able to evaluate it," he states. “You don't toss a client party Until you are aware of precisely what you should get out of it.

Servicing is the gathering of payments from issuers and payment of gathered money to claimants. Furthermore, a servicer maintains payment information, screens contracts, and pursues defaults. In a lot less made economies, this aspect of financial provider is fairly invisible.

Tightening up financial terms for almost any accounts or payments you continue a every month foundation can also assist together with your hard cash move and mitigating financial risk. Test bringing Web thirty day terms right down to 25 and even twenty days, and in some cases contemplate bimonthly billing.

“Anyone wishes to believe their enterprise is sort of a awesome little spouse and children, but you will find possible financial risk that could be a significant drain on assets, produce superior lawful costs and have an effect on company culture and productiveness," he says.

Becoming a company proprietor is thrilling, but it surely comes with its reasonable share of troubles. A type of issues would be the immense financial risk you think when your online business is your Main supply of profits.

Both Office of Investments or Procurement will validate the specific stipulations of your by-product trade Together with the counterparty or expenditure supervisor, as applicable;

Financial Expert services is accountable for pinpointing the right accounting remedy for every spinoff transaction and for carrying out reconciliations of information and studies amongst Workplace of Investments and also the College’s information.

The introduction of inventory market index futures has offered a second means of hedging risk on just one stock by offering short the marketplace, as opposed to A different solitary or choice of stocks. Futures A Fantastic Read are generally highly fungible[citation needed] and cover numerous types of probable investments, that makes them simpler to use than endeavoring to obtain One more stock which somehow signifies the other of a particular investment.

Because the trader is serious about the precise firm, as an alternative to the whole field, he really wants to hedge out the industry-linked risk by shorter marketing an equivalent price of shares from Organization A's direct, still weaker competitor, Firm B.

Guaranteeing that publicity to any counterparty is restricted to amounts proven less than this policy as up-dated from time-to-time;

Intermediation is the simultaneous challenge and buy of various financial statements by only one financial entity. It occurs when an institution buys a single form of financial instrument for its personal account and finances the transaction by issuing a claim against its personal equilibrium sheet.

How Hedging In Financial Risk Management can Save You Time, Stress, and Money.

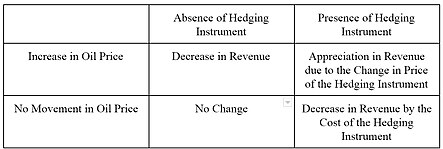

By: Hunkar Ozyasar A hedging transaction can get rid of the opportunity of losses while in the financial markets.

Airlines use futures contracts and derivatives to hedge their exposure to the price of jet gasoline. They know that they have to invest in jet gasoline for as long as they want to stay in enterprise, and gasoline prices are notoriously risky. Through the use of crude oil futures contracts to hedge their fuel requirements (and interesting in related but far more sophisticated derivatives transactions), Southwest Airlines was in a position to help you save a large amount of revenue when obtaining gasoline when compared with rival airlines when gasoline charges inside the U.S. rose dramatically following the 2003 Iraq war and Hurricane Katrina. Hedging feelings[edit]